In the fiscal year 2018, India imported around $2 billion of electronic products such as televisions, washing machines, digital cameras etc.

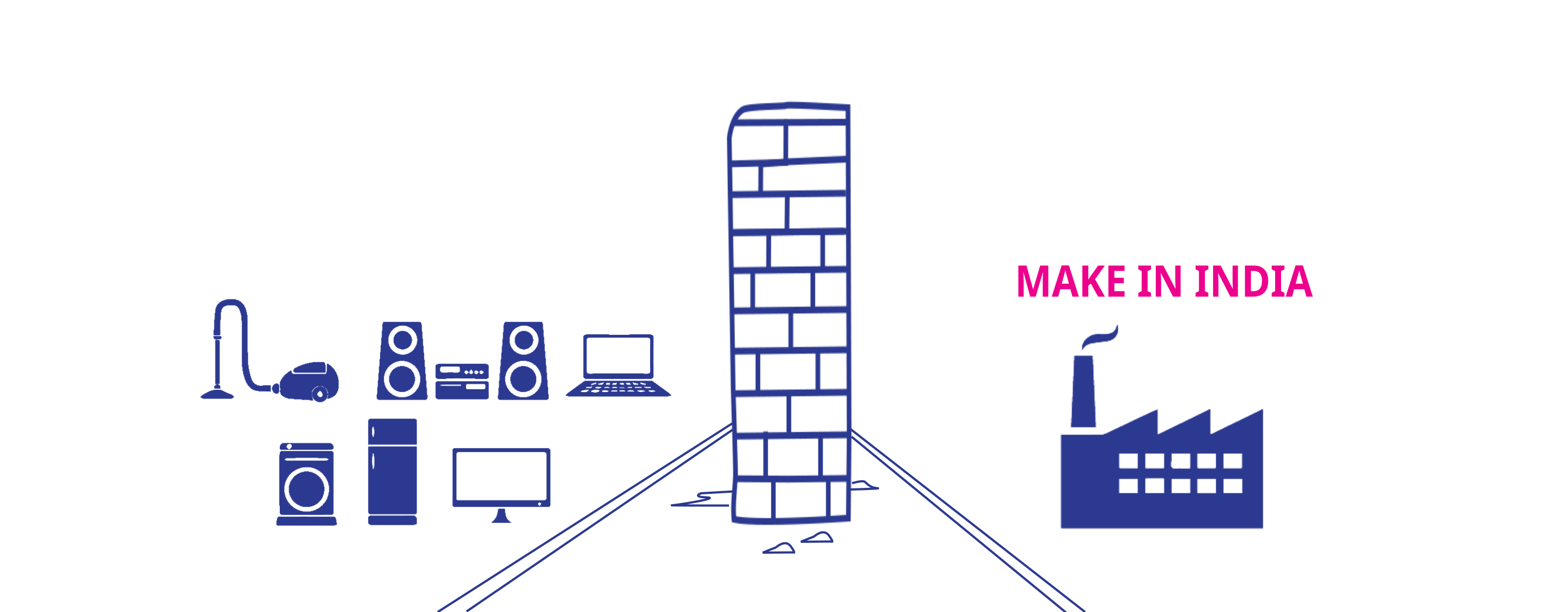

In order to give a boost to local manufacturing under the Make in India initiative, government is contemplating raising the import duties on consumer durables such as television, washing machines, and refrigerators. The government is aiming to bring these consumer durables under phased manufacturing plan (PMP) and increasing the import duty on some of the finished products.

Considering that India is a very big market, the government perceive that electronics and telecom products should be manufactured in India and there should be less dependency on imports of these products.

In the fiscal year 2018, India imported around $2 billion of electronic products such as televisions, washing machines, digital cameras etc. Currently, these products attract 10 percent of customs duty. However, the local manufacturers are demanding an increase in the import duty from 10 percent to 20 percent. This indicates that local manufacturers want to stay away from competition, so they can dominate the electronic market in India.

The government is protecting the local manufacturers by raising import duties on electronic products. And why wouldn’t they do that? After all local manufacturers form a strong pressure group.By doing this the government is making a small group of people better-off (the manufacturers) by making things worse-off for a large group of people (the consumers).

Read More: What makes your iphone so expensive?

The higher import duties would increase the price of televisions, washing machines and refrigerators for consumers. The domestic companies which are protected from foreign competition will have no incentive to improve the quality of their products and reduce the cost of their production. As a result, the price of domestic electronic products will rise. In the long-term, these domestic industries will lose their productivity as they are not competing with the global market.

The reduction in import of electronic products will restrict the choice for consumers as they have to depend on electronic products that are domestically produced and pay more for them. Therefore, if there would have been an availability of cheaper imported electronic products than a consumer would have saved money and spent it on some other goods and services which would have contributed to the economy’s growth.

The government wants to boost local industry to create more local jobs. In order to protect some jobs, there is a threat to the jobs of people working in an industry which rely upon the cheap imported electronic products.

There should be no trade barriers such as import duties and quotas. Instead, there should be a free trade where consumers are free to buy goods from anywhere in the world and local manufacturers are free to sell their produce anywhere as well.

An increase in the competition among manufacturers ensures a better quality of products and reduce the price of goods. It also increases the choice for consumers, as more goods are available in the market and more jobs are created by the entry of new players in the market.

If government raise the import duty on electronic products then it will end up hurting the consumers instead of benefitting them and in the long run, it will have a negative impact on the productivity of local manufacturers.

Read more from our Daily Section